Understanding tax systems and the payment methods is crucial when it comes to doing business in a country! Today, we focus on some of the hurdles businesses in Malta faces, and try to come up with the best available solutions.

Understanding corporate taxes in Malta

This tiny country has a favourable tax regime and attracts businesses from all over the world.

- How does corporate tax work in Malta?

- What is their overall tax system like?

- What are the different company tax rates?

- And how can you implement some tax-saving strategies?

Let’s dive in to find out the answers to these questions and better understand some of the nuances of Malta’s tax landscape.

Your business in Malta

Malta’s tax system has been carefully designed to attract businesses and ensure fiscal sustainability. Malta has a strategic location and European Union membership. The country's legal system is robust and the environment is conducive to economic growth. It sounds ideal, right?

When running a business you should always have a good idea of everything related to corporate taxes in order to strategically advance your business. Proper tax planning will significantly impact your company’s bottom line and the overall financial health of your business.

We want your business in Malta to thrive. That is why we’ve created this handy guide to talk you through the complex terrain of corporate taxes in Malta. From corporate income tax to value-added tax (VAT), capital gains tax, and withholding tax – we'll cover it all. As a bonus, we’ll give you some tips on actionable tax-saving strategies that can help optimise your company's tax liability in Malta.

Types of corporate taxes in Malta

Corporate Income Tax

At the heart of Malta's tax system for companies lies the corporate income tax. As previously stated, this is very important for you to understand! Malta operates on a full imputation system. This means that when a company pays tax on its profits, shareholders are entitled to a tax credit equivalent to the tax paid by the company. As of the last update, the standard corporate income tax rate stands at 35%.

35% is already a competitive rate by international standards. But there are more to this rate taking into account the incentives and types of businesses. We’ll not get into that part right now, you can find all about it in our other guide. All you need to know is, whether it be a 35% flat rate or something less, in Malta you will pay the full rate, and then reimbursed the amount. An important detail that you should definitely know especially if you’re applying for the extra incentives.

Taxable income calculation for corporations

There are various components to think about when calculating taxable income. These include deductible expenses and allowable deductions. Make sure to familiarise yourself with these elements to accurately determine your company's taxable income and corresponding tax liability. We recommend to get the most current information from your accountant to create your own deductible list based on your enterprise.

Distribution of dividends and associated tax implications

Dividends are a common way for companies to distribute profits to shareholders. In Malta, the tax implications of dividend distribution are tied to the imputation system. The tax credits mentioned earlier can offset tax on dividends. This makes Malta an attractive location for holding companies.

Value Added Tax (VAT)

Value Added Tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production or distribution. In Malta, VAT is an essential component of the tax system. VAT significantly contributes to the government's revenue.

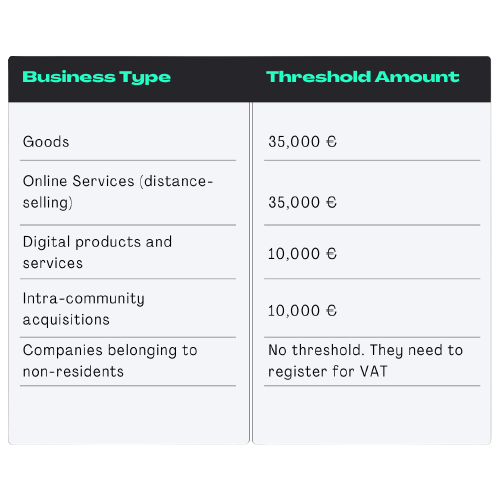

VAT registration thresholds and requirements

Companies whose turnover is more than a certain amount will need to register for VAT. You will need to understand the registration thresholds and their obligations in order to comply with the tax regulations in Malta. Check out our table below for some simple rule of thumb but always remember to double-check with your account for the final say.

VAT rates for different goods and services

Although a standard rate of 18% is employed in general, Malta has a tiered VAT rate system to account for some of the non-standard items. The standard rates and reduced rates applicable to various goods and services can be checked in the Maltese commissions for revenue website.

Capital gains tax

Capital gains tax is applied when your company disposes of capital assets like property, investments, intellectual property, permits. Depending on the sale type, the nature of sale, the remittance details, the date the capital was acquired, the tax rates would vary.

If you are subject to paying capital gains tax over selling a property, one more thing you should pay attention to is the “PTT”. A PTT is not considered a tax type but a transaction cost. The rate is a flat %8 unless the property was acquired before 2004, in that case the rate bumps up to 10%.

Knowing the correct rates will help your decision making when selling assets. Therefore, an accountant or expert opinion should be taken into consideration for each case separately.

Individuals should take note that capital gains, which are exempt from final income tax, must still be reported under the entire income levy. This ensures a unified taxation process for the complete amount.

Exemptions and reliefs available for capital gains

Malta also provides opportunities for capital gains tax exemptions. For instance, the sale of real estate or immovable property can be exempt from this levy if it served as the taxpayer's sole residency for a minimum of 3 years.

Withholding tax

Withholding tax, often referred to as retention tax, is a tax levied at the source of income rather than at the recipient's end. In the context of Malta, withholding tax is applicable to specific types of income and is meant to be deducted by the payer before the payment is made to the recipient. Withholding tax in Malta is commonly applied to interest, royalties, and dividends paid to non-residents.

Rates of withholding tax for various payments

The withholding tax rates can vary depending on the type of income and the tax treaty agreements between Malta and the country of the recipient. For instance, under most Double Taxation Agreements (DTAs), the withholding tax rate on dividends is often reduced to a lower rate than the standard rate.

Different types of payments are subject to varying withholding tax rates. These include royalties, interest and dividends. Knowing these rates ensures accurate tax deduction and compliance with international agreements.

Double taxation treaties and their impact on withholding tax

Double taxation treaties play a vital role in preventing double taxation on the same income in different countries. Malta has an extensive network of these treaties. The treaties influence the withholding tax rates applicable to cross-border transactions.

Strategies to reduce corporate tax liability in Malta

After looking at the different types of corporate taxes in Malta, now it's time to explore actionable strategies to optimise your company’s tax liability. All of this within Malta’s legal framework, of course.

Tax incentives available in Malta and how to take advantage of them

As we’ve gathered, Malta wants to attract businesses and stimulate growth. It makes sense then that they offer various tax incentives to help you out. These incentives are designed to encourage specific activities such as research and development (R&D), investment and job creation. Below we outline some of these incentives.

Research and development (R&D) incentives

Innovation and technological advancement are key to growing any economy. In order to reach that point though, a lot of research and development is needed. That is why in Malta, if your company is engaged in R&D activities, you can benefit from tax credits and deductions.

Intellectual Property (IP) regime and benefits

Malta's IP regime provides a favourable environment for companies holding intellectual property rights. Income generated from IP assets may be eligible for reduced tax rates. These benefits encourage companies to further explore and expand on their intellectual property strategies.

Special Deals for Maltese Businesses by Local Powerhouse wamo

1% Cashback campaign for Malta tax payments with wamo business debit card

wamo Introduces a unique opportunity for businesses operating in Malta! wamo's exclusive cashback campaign lets you earn rewards while fulfilling your tax obligations to the Maltese government. With this campaign, your business can earn 1% cashback on a variety of tax payments, including income tax, VAT, Social Security contributions, corporate taxes, and more. wamo’s plans even extends beyond the tax payments and includes all payments made to the government, including those you pay for a fine, contribution, and various other fees.

wamo’s new cashback campaign is pretty straightforward. All you have to do is:

- Register a business account at wamo.

- Complete your onboarding.

- Create your visa debit card in the app.

- Follow our guideline to complete the payment process here

A standard 1% cashback will be given to all the businesses registered in Malta, if they make these payments with their wamo business debit card. The deal is valid for 1 year, starting 1st of September 2023. You can check the terms and conditions in this page to make sure you are eligible to earning this 1%. Or you can directly contact our team to begin your onboarding.

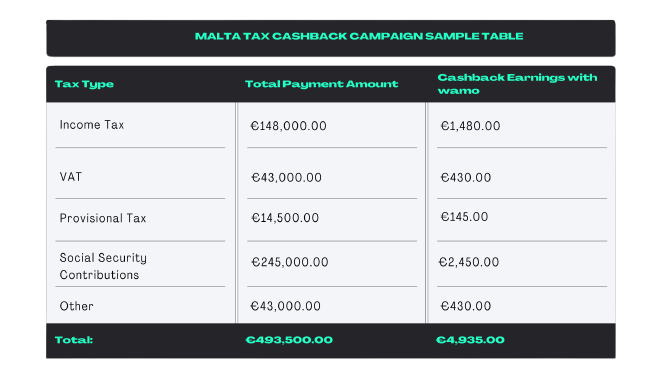

Only to help you imagine, we created this sample chart we took from an anonymous real business, and applied wamo’s cashback earning offer to see how much they could make last year, and how much they will potentially earn this year.

Importance of choosing the right legal structure

The legal structure of your company plays a significant role in determining its tax liability. Opting for the right structure can lead to substantial tax savings. Holding companies, for example, enjoy certain tax advantages. These include participation exemption on dividends and capital gains, making them a strategic choice for group structures. Group companies can benefit from provisions that allow for the offsetting of profits and losses within the group. This optimises the overall tax position.

Tax planning for dividends and distributions

Strategic timing of dividend distributions can have an impact on your company’s tax liability. Once you understand the nuances of dividend taxation you can ensure optimal financial planning.

Participating holding exemption and reduced tax rates

Dividends received from qualifying participating holdings may be exempt from taxation or subject to reduced tax rates. This enhances the attractiveness of investing in subsidiaries.

Utilising double taxation treaties

Double taxation treaties eliminate or reduce the risk of double taxation for companies operating internationally. Understanding these treaties and their implications is essential for minimising withholding tax and avoiding double taxation. Double taxation treaties often stipulate lower withholding tax rates on cross-border payments, facilitating smoother international transactions.

Compliance and documentation

Maintaining comprehensive and accurate records is a fundamental aspect of tax compliance. Always make sure you have excellent records of your financial transitions. This will help have positive outcomes on your company’s financial decisions and tax positions.

Transfer pricing documentation and its significance

For companies engaged in cross-border transactions with related entities, transfer pricing documentation ensures that transactions are conducted at arm's length. This is done in order to comply with international standards and regulations.

Armed with these strategic insights, you can navigate Malta's corporate tax landscape with confidence. You’ll be able to make informed decisions to optimise your company's tax liability while staying compliant with the law.