In the world of digital finance, there are many options to choose from. We’re going to look at two popular offers from wamo and Verto. The question we’re hoping you’ll be able to answer at the end of this article isn’t necessarily which one is better, but which one is the right choice for your business? If your business involves international transfers, this will be the area of focus for this comparison, so hopefully you’ll find it useful!Let's take a closer look at both options to see which one comes out on top.

Established in the UK in 2017, VertoFX has become a popular choice for businesses looking to make international money transfers. Since it was founded, the company has transferred billions to customers with more than 2000 customers worldwide, they offer exchanges in over 50 currencies. The platform allows businesses to accept payments globally and send payouts to their employees. wamo is a financial service provider and payments platform that is becoming known for its excellent customer support, low-cost subscription plan and fee-free services. With an aim to enhance the financial operations of small to medium businesses and to make a business account accessible to everyone, the company is enabling various business owners to open and run international business in the EU and the UK. Both companies provide top-notch financial services and ease when transacting payments internationally and in multiple currencies, unlike traditional banks, they’re faster and more flexible to use across the board.

wamo vs VertoFX: How do they work?

Both wamo and VertoFX offer online money transfer services. They allow businesses to send and receive payments in foreign currencies. Both services use bank-to-bank transfers, so you can be sure that your money is safe and secure. With wamo, you can register an account in 10 minutes and start doing business as soon as your account gets verified. The wamo desktop and app versions work equally well. VertoFX gives you access to make international payments through a single API or web platform.

VertoFX vs wamo: What are the subscription plans?

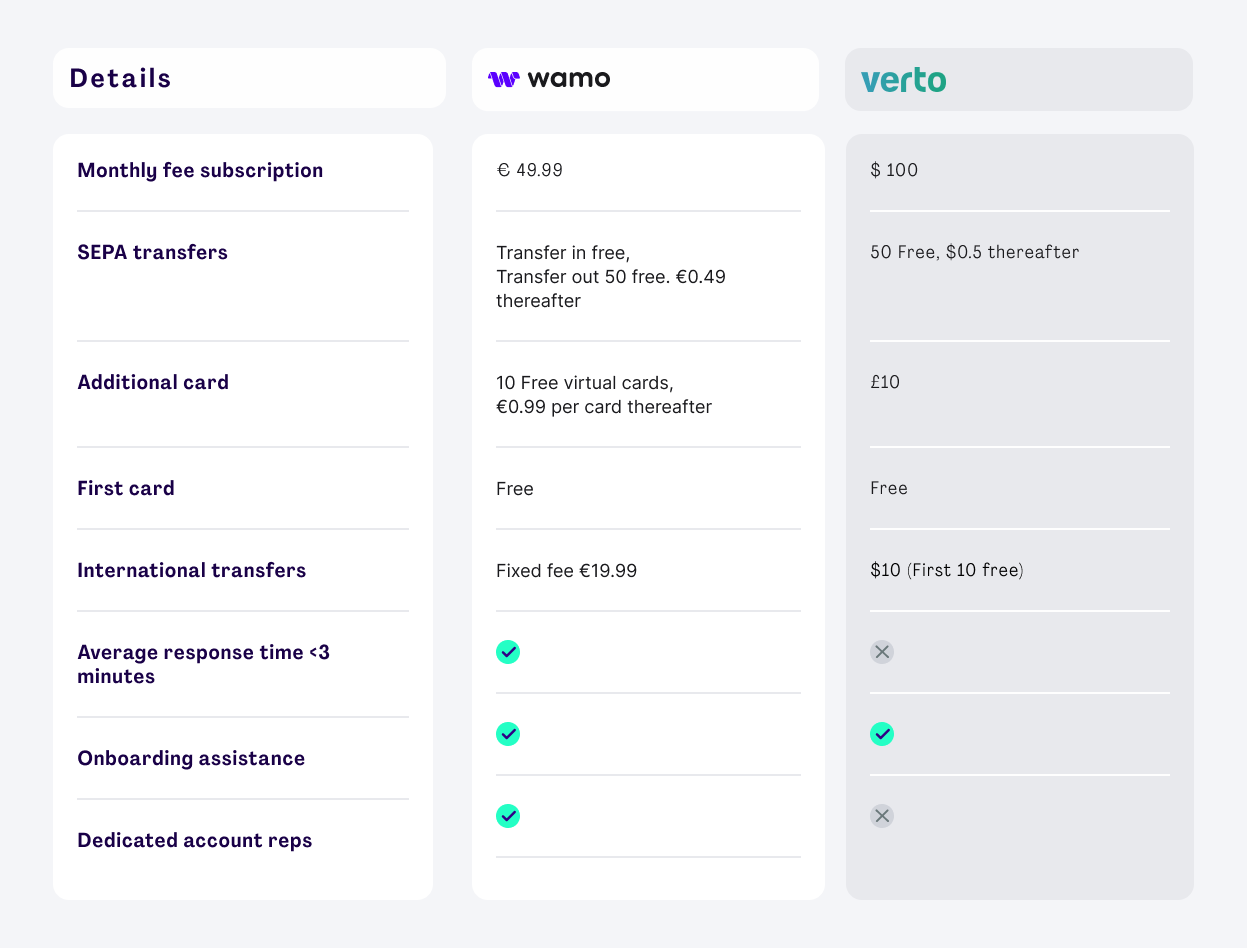

VertoFX now charges a monthly fee of $100, with potential extra fees for transfers, leading to unpredictable costs each month. In contrast, Wamo's Grow Plan has a fixed monthly fee of €49.99, providing predictable costs without surprise fees.

In comparison, wamo offers a transparent fixed fee of only €19.99 for each international money transfer, and lower fees for local money transfers, regardless of the amount you would be sending. wamo also lets you make SEPA transfers for free which means you can make local transfers without worrying about heavy fees. Also, if your business requires you to carry out everyday local transactions, wamo’s feature can save you a lot of money over time. Since it doesn't have any hidden fees, you will always know exactly how much your recipient will receive and how much you are paying towards international transfers, for example.

All in all, when it comes to choosing a digital financial solution for your business, both wamo and VertoFX are good options. They both offer excellent customer support, dedicated account reps, online money transfer services with competitive exchange rates, flat transaction fees. While you pay less with wamo, you get a lot more features with it which have the ability to save you money in future. Ultimately, the decision of which digital financial solution to use for your business comes down to personal preference and needs.

Interested in trying wamo? It’s possible to register for an account in 10 minutes and to have a full business account up and running within 24 hours. You can download wamo from the App Store and Google Play and if you have any questions, hop on over to the website and reach out through Chat.