Being a business owner of a limited company in the UK, you are probably familiar with the term “corporation taxes”, but have you ever wondered what it means for your company? In basic terms, it is the taxes that are charged on the profits you make in your company throughout the financial year. In this blog post we’ll take a deeper look into what exactly this means for you and your business.

While filing taxes can seem a bit daunting and complicated, it’s just about investing time and seeking the right guidance. In this blog post we’ll share everything about Corporation Tax that you need to know to be able to prepare and file your taxes. So let’s get this started!

What is corporation tax in the UK?

Alright, so let’s get down to the nitty-gritty of corporation taxes in the UK. These are the taxes that you pay for your company’s profits. As a limited company owner in the UK, you will have to pay a percentage of your yearly profits to the UK government. The current tax rate set up by the government is 19% for all limited companies, regardless of your company’s size or turnover.

For example, if your company is making a profit of £100,000, you will be paying £19000 toward corporation tax to HM Revenue and Customers (HMRC). But don’t worry, you will be able to deduct any expenses or allowances that you are entitled to before calculating your final tax bill, which we’ll share more information on later in this blog post.

It’s also worth noting that corporation tax differs from other taxes you may have heard of – such as VAT or PAYE. These taxes are based on transactions or types of income. On the other hand, corporation tax is something that you pay on your company’s profit. So if you are a sole entrepreneur or in a partnership, you will not be paying corporation taxes.

So, who needs to pay corporation taxes in the UK? The HMRC has mentioned that if you fall under one of these categories, then you will be paying taxes:

- a limited company

- a foreign company with a UK branch or office

- managing a club, cooperative, or any other unincorporated association like a community group or sports club

Tax authorities in the UK

As we mentioned earlier, you pay taxes to HMRC – it’s the government who are responsible for administering corporation tax in the UK.

As a limited company owner, you are expected to file a Company Tax Return with HMRC every year, which includes details of your company’s income, expenses and profits. You will also need to consider paying any corporation tax owed by the deadline, which is usually 9 months after the end of your accounting period.

How to register for corporation taxes in the UK

Now that you know about corporation taxes, it’s time to understand how to register for taxes as a limited company. You have to register for corporation tax with HM Revenue and Customs in the first three months of starting to do business. The process is not too complicated, here’s a breakdown of how it works:

- Visit the HMRC website and create an online account.

- Enrol for corporation tax online and provide your company’s details, such as your company registration number, date of incorporation, and the date you started trading.

- Once your registration is complete, HMRC will send you a Unique Taxpayer Reference (UTR) number and confirmation of your corporation tax registration.

- You can then set up a Direct Debit to pay your corporation tax, or you can make payments using other methods such as online banking or a bank transfer.

Make sure you register within the three-month deadline to avoid any issues, as there can be penalties from HMRC if you don’t register in time.

Minimising corporation tax

There are a few ways you can legally reduce your tax liability, here are a few below:

- Claim all allowable expenses: Make sure to keep up-to-date records of all your business expenses and claim everything you're entitled to! This can include things like office equipment, travel costs, and professional fees.

- Make use of tax reliefs: There are some tax reliefs and allowances offered by the government to reduce your corporation tax bill, so make a note of which might apply to your business.

- Pay yourself a salary and dividends: As a director of a limited company, you can pay yourself a combination of salary and dividends. Dividends are taxed at a lower rate than income tax, so this could end up reducing your overall tax liability.

- Plan your investments: As a limited company, if you plan on making any big investments, such as buying a new property or a heavy piece of equipment, it may be worth timing it to maximise any available tax allowances.

To make sure you don’t miss out on any tax-saving opportunities, it will be useful to consult with a tax professional for advice, especially when you’re just getting started with a new business in the UK.

Corporation Tax rates from April 2023

From April 2023, there has been a slight change in the corporation taxes in the UK. The government announced plans to increase the corporation tax rate from 19% to 25% by April 2023.

The rate will gradually increase to 25% for companies with profits over £250,000 in April 2023. However, if you’re earning profits under £50,000, you will still pay tax at the current rate of 19%, and those with profits between £50,000 and £250,000 will pay a tapered rate.

The changes in corporation tax rates can have a big impact on the finances of your business, so keep yourself up to date with any news related to this. Here’s what the taxes will look like from April 2023:

- If a company's profits are less than £50,000, then corporation tax will be charged at 19%.

- Profits between £50,000 and £250,000 will also be taxed at 19%, but they'll also be subject to Marginal Relief, which can increase their effective tax rate.

- Companies with profits over £250,000 will be paying a higher rate of 25%.

The companies in the middle bracket might end up paying more than before because of the Marginal Relief calculation. But don't worry, the government's got a handy calculator to help you work out how much Marginal Relief you can claim and what your effective tax rate will be

Corporation tax reliefs in the UK

Thankfully there are a number of corporation tax reliefs available in the UK, which can help to reduce your company's tax bill. Here are some reliefs to consider:

- Research and Development (R&D) tax relief: If your company’s activities are engaged in innovative R&D activities, you may be eligible for tax relief. This relief enables you to deduct an extra 130% of qualifying R&D costs from your taxable profits, which is on top of the normal 100% deduction.

- Capital allowances: So if you are planning to buy assets for your business, probably machinery or equipment, you can claim capital allowances. These allowances let you deduct a percentage of the asset cost from your taxable profits.

- Creative industry tax reliefs: If you are running a company in the creative industries such as film, television or video games, then you can claim special tax reliefs specific to these kinds of industries. Here you can save tax on production costs, theatre production tax relief, and video games tax relief.

- Patent box: If your company owns patents, there are lower rates of corporation taxes available on profits earned on patent inventions or innovations. This allows you to apply a 10% corporation tax on profits.

- Disincorporation Relief: This is a relief that small companies can use when they want to transfer their business to a sole trader or partnership. Disincorporation relief allows you to transfer your business assets to the new entity without incurring a capital gains tax liability.

How to pay corporation tax in the UK

Here's a breakdown of the steps involved in paying corporation tax in the UK:

- Make sure that you are registering your company for corporation tax within three months of starting your business or beginning to trade.

- Whenever you are making a big purchase or investing amounts that qualify for relief during a financial year, make sure to keep an accurate financial record of it. This will help you calculate your tax liability and complete your tax return with ease.

- Calculate your corporation tax liability for the financial year, which runs from 1 April to 31 March. This will involve deducting allowable expenses and reliefs from your taxable profits.

- Once you have done that, complete your corporation tax return. This will include detailed information about your company's income, expenses, and tax reliefs. You can file your tax return online using HMRC's online service or by post.

- Make sure to pay any corporation tax due by the deadline, which is usually nine months and one day after the end of your financial year. You can pay online, by bank transfer, or by cheque.

- Keep records of your corporation tax payments and filings for at least six years in case of a tax audit or investigation.

When should you pay your taxes in the UK?

So, here’s the deal with corporation tax payment deadlines in the UK – it can get a bit complicated and tough to understand. But don’t worry, here’s a quick breakdown for you:

- Note that you pay your corporation tax before you file your company tax return.

- Keep your tax information ready in advance as the deadline for paying your corporation tax is nine months and one day after the end of your accounting period for the previous financial year. If your accounting period ends on March 31st for example, your corporation tax deadline is January 1st.

- If you want to know how much corporation tax to pay, you also need to prepare your company tax return – even though the deadline for filing that return is later (12 months after the end of the accounting period it covers).

- If you've just started your small company, you may have two corporation tax accounting periods, as your accounting period can't be longer than 12 months. If you start your business in January, your first accounting period can go up to March 31st, and then you'll start a full 12-month accounting period.

- Businesses with profits over £1.5 million must pay their corporation tax in instalments, which is a bit different.

Is there any threshold for taxes?

In the UK, corporation tax has no threshold, therefore all limited companies are expected to pay it on their profits.

But before 2015, things were a little different. The amount of Corporate Tax you paid back then was based on the revenue your company generated. You would pay 20% tax on profits up to £300,000 in that case (known as the "small profits rate"). But, if your revenue exceeded £1,500,000, you would have to pay a rate of 21% (known as the "main rate").

Businesses whose profits were in the middle of those ranges paid a hybrid rate that was in the middle of the small and major rates. Before then, there was a bigger difference in the rates. But, as of April 2023, the new rates will be similar to before, with lower thresholds.

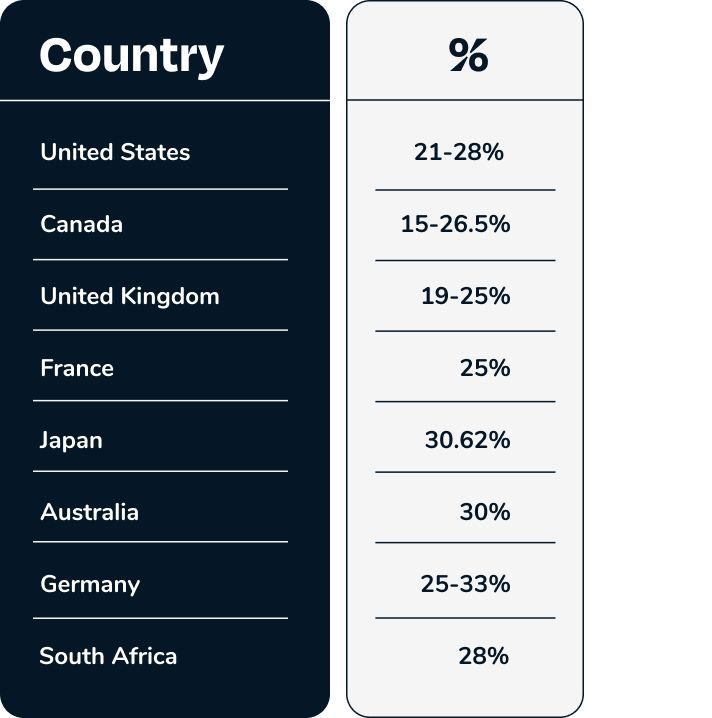

Corporation taxes in other countries

Corporation taxes vary from country to country. With the UK being one of the most tax-favourable countries, company owners have also considered it an attractive location to operate and run a business. However, with the increased tax rates introduced by the government, new business owners seem curious if they should still consider running a business in the UK.

Well, the great news is that the country still remains a great place to explore business opportunities with one of the lowest taxes, skilled labour and huge access to the EU markets. Here's a quick comparison of current tax rates in other countries:

Impact of tax rate changes on dividends

Simply put, when a company earns profits, it pays corporation taxes on those profits. Once the tax has been paid, the remaining profits are distributed to shareholders as dividends. When the tax rate increases, it leads to lower dividends. The change in the UK's tax rate in 2023 may impact dividends paid to shareholders. As the corporation tax rate will increase to 25% for companies with profits above £250,000, this means there will be less profit available for distribution as dividends. Obviously the impact on dividends will change depending on each company's specific circumstances, like their profits, revenue, and financial goals. Of course, tax rate changes are one of the many factors that affect dividends and companies can adjust their dividend policies to meet the requirements.

Do all limited companies pay corporation taxes in the UK?

Well yes, all limited companies have to pay corporation tax in the UK. Corporation tax is based on the profits earned by companies, and it is used to fund public services and government spending. Even if the company has made a loss, it still needs to file a tax return to inform HM Revenue and Customs (HMRC) that no tax is due.

So, basically, when it comes to Corporation Tax, your limited company's taxable profits are what you need to focus on. These profits include the money your company makes from doing business, investments, and selling assets for more than they cost.

If your limited company is based in the UK, it has to pay Corporation Tax on all its profits from both the UK and abroad. However, if your company is not based in the UK, but has an office or branch in the country, then you only have to pay Corporation Tax on the profits that come from your UK activities.

Tax calculator

We hope this guide was helpful in preparing you for the UK’s tax season. If you are ready to start your tax filing process, you can easily find your corporation tax amount using a limited company tax calculator. This is a useful way to get your taxes in order way in advance so that you have a better idea of what you’ll owe to HMRC. Generally, you need some details including:

- annual revenue

- gross salary

- yearly expenses

- and annual pension contributions

If you want more information about the UK's financial system or running a business there, keep exploring more here!

Get your wamo business account

At wamo we’re big into human-centred customer support – so reach out to us via email on support@wamo.io or start a conversation with us via the chat bot on our website. A helpful wamo team member will happily walk you through everything.