One of the great benefits of running your business online is that you can trade internationally fairly easily. If you are running an e-commerce platform and selling your products to another country, it is a great idea to make the payment process for your customers as seamless as possible. This would include ensuring you can offer them the best currency conversion and cross-border fees available.

Using wamo's borderless account can help mitigate these fees by allowing your customers to pay in their own currency and by providing competitive exchange rates. We’ll share more details of how to accept online payments later on in the blog post.

As a seller you’ll need to make sure you comply with the regulations and laws of the country you are selling to. This could mean you need to get licences and register for taxes specific to the countries you’re trading in. In this blog we’ll share how you can get your e-commerce website ready to receive online payments internationally.

How do e-commerce payments work if you are an international seller?

Here are four key considerations for you to keep in mind when accepting online payments as an international e-commerce seller,:

- Ensure that your website and checkout process can support multiple languages and currencies. This will make it easier for customers to understand the products, prices and make e-commerce payments in their own currency.

- Consider which payment methods to offer. Popular options include credit and debit cards, bank transfers, and e-wallets. However, most countries may have different preferred payment methods. For example, in some countries, e-wallets like Google Pay are more commonly used than credit cards. Take some time to understand the needs of your potential customer base to make e-commerce payments as easy as possible for them.

- Check that your website and gateway payments are secure. This will protect your customers' sensitive information and help to prevent fraud. It is important that customers trust your online payment methods in order for them to keep coming back and also so they can recommend your platform to others.

- When taking online payments be aware of and comply with the regulations and laws of the country you are selling to. This may include obtaining licences and registering for taxes in that country.

Let's understand what online gateway payments are

A payment gateway is a technology service that acts as an intermediary between a merchant's website and the financial institution that processes the payment. When a customer makes a purchase on an e-commerce website, the payment gateway securely passes the customer's payment information to the appropriate financial institution for processing. The payment gateway then communicates the result of the transaction back to the merchant and the customer.

Payment gateways use encryption and other security measures to protect sensitive customer information, such as credit card numbers and personal details, during the transaction process. They also perform fraud detection and prevention to help protect merchants from unauthorised transactions.

Some examples of payment gateway providers include PayPal and Mollie. These providers offer a variety of payment gateway services, such as the ability to accept credit and debit card payments, e-checks, and other forms of electronic payment. Some payment gateways like Wise also provide additional services such as fraud prevention, recurring billing, and PCI compliance assistance. Do a thorough search to find out what will work best for your business and customers before deciding which service to use.

Benefits of taking online payments on your e-commerce website

Security:

Payment gateways use encryption and other security measures to protect sensitive customer information during transactions, helping to prevent fraud and keep customers' information safe.

Convenience:

Payment gateways allow customers to make purchases quickly and easily, without the need to mail in a check or call in their credit card information. This can lead to increased sales and customer satisfaction.

Increased payment options:

Payment gateways can support a wide range of payment options, including credit and debit cards, e-checks, and other electronic payment methods. This can help increase sales by making it easy for customers to pay with their preferred method.

Automation:

Payment gateways automate the process of payment, which helps to reduce errors and save time. This can be helpful for businesses that process a high volume of transactions.

Fraud detection:

Payment gateways typically include fraud detection and prevention tools that help to protect merchants from unauthorised transactions.

Cost-effective:

Payment gateways can be cost-effective for businesses, especially small businesses, as they don't require a large up-front investment or ongoing maintenance costs.

Reporting and reconciliation:

Payment gateways provide detailed reporting and reconciliation tools that help businesses track and analyse sales data, which can be useful for improving business operations and making informed decisions about future investments.

How does an online payment system work?

Online payments are generally convenient, secure and fast and the ever-growing demand for efficient systems has accelerated a lot of technology related to e-commerce. As an e-commerce business, it is important to keep up with the most convenient and safe payment options for your customers. By accepting online payments, and more specifically having efficient systems or payment gateways in place, you can expand your customer base and increase sales by making it easy for customers to purchase your products or services.

To ensure you have a wide and growing customer base, make sure to offer a variety of payment options, such as credit and debit cards, bank transfers, e-wallets, and direct debit. The easier it is for customers to pay with their preferred method, the more products and services they’ll buy from you.

It’s clear that offering online payments can help improve the customer experience and increase sales for your e-commerce business. Now let’s get into a bit more detail on options and setting up your e-commerce payments for you to easily accept online payments.

E-commerce payments from marketplaces

Marketplaces are third-party platforms that connect buyers and sellers, and typically handle the process of listing products, managing inventory, and facilitating payments. E-commerce payments from marketplaces refer to accepting payments for products or services sold through online marketplaces such as Amazon, eBay, or Etsy. When a customer buys a product or service on a marketplace, the payment is processed by the marketplace's payment gateway and the funds are transferred to the seller's account.

As a seller, you will need to set up an account with the marketplace and configure your payment settings to accept payments. This will typically involve linking your business account or setting up a payment processor such as PayPal.

By using a marketplace, the customer is essentially buying from the marketplace, not from you directly. So, the marketplace acts as an intermediary, handling the purchase and payment process on behalf of you, the seller. Marketplaces sometimes might also offer additional services like shipping and customer service.

How to get ready to receive online payments and what to do next

Credit and debit card payments

One of the more popular modes of online payments is for sellers to accept credit and debit card transactions. This is especially the case for international e-commerce businesses as they’re often set up to approve payments from the major card companies. When a customer makes a payment, all their information is securely transmitted to the payment gateway (as described earlier in this post). The payment gateway then communicates with the customer’s financial institution to process the payment.

To accept online payments through credit and debit card transactions, you will need to set up a merchant account with a payment processor like PayPal or something similar. Your merchant account is usually set up through a bank or financial institution and it will allow you to accept credit and debit card payments.

You’ll need to integrate a payment gateway into your e-commerce platform. Many website templates have easy to use plugins for this. Payment gateway providers like Mollie or PayPal offer integration options such as API or plugins too. This allows you to securely transmit customers’ payment information to the payment processor for processing. If the setup seems overwhelming, there are many third-party service providers and web developers who are experts at this kind of thing! In summary, you’ll need to follow the steps below to get started with receiving online payments:

- Choose a payment processor such as PayPal, that supports credit and debit card payments as well as multiple currencies.

- Sign up for a merchant account with the payment processor. You will typically need to provide personal and business information, as well as verify your identity.

- Integrate the payment gateway into your e-commerce platform. This can usually be done by installing a plugin or using API integration. The payment processor should have documentation and support resources to help you with this process.

Using a payment facilitator

A payment facilitator is a third-party service that enables businesses to accept and process payments online. Payment facilitators typically offer a range of services, including payment gateway integration, fraud detection and prevention, and compliance with regulatory requirements.

Using a payment facilitator can be a good option for international e-commerce businesses, as they often support multiple currencies and can handle the complexities of cross-border transactions. Additionally, they can provide support for local payment methods that may not be available through traditional payment gateways.

To use a payment facilitator, you will typically need to sign up for an account and integrate the payment facilitator's services into your e-commerce platform. Some popular payment facilitator providers include PayPal, Sage Pay, Mollie, etc.

It's worth noting that, similar to payment gateway providers, payment facilitators also charge fees for their services. This is often a flat fee, but make sure to check and compare fees, services and compliance requirements of different payment facilitators before choosing one for your company. These fees can add up quickly, so it is worth spending time doing your research before signing up.

Receiving direct money

Receiving payments online through direct debit is another option for e-commerce companies that can be efficient and provide consistency. Direct debit is a payment method where a customer authorises a business to automatically debit a specified amount from their business account on a recurring basis. An example of where this might be used is typically for subscription services, like your gym membership or a monthly donation to your local charity.

Here are some pointers on how an e-commerce company can receive payments online through direct debit:

- Sign up for the Bacs Direct Debit scheme to accept payments through Direct Debit, giving you access to the Bacs network, which is the primary network for processing Direct Debit payments in the UK.

- Contact your bank to ensure that your business account is set up to receive direct debit payments, and ask for any necessary forms or documentation required.

- Get the necessary authorisations and mandates from customers to make sure the direct debit process is set up correctly and will run smoothly.

- Next, you will be given the decision on how to submit the direct payments. Your Bacs system will require you to submit payment files with the information you need to take direct debit payments from your customers.

After Bacs sends the data to your customers' business accounts, they approve and organise the payments. Bacs accepts these files in two ways; by you doing it yourself, or through a direct debit bureau.

1) Doing it yourself – SUN number and Bacs-approved Bacstel-IP software

A SUN number is a unique number assigned to your business by Bacs. It allows you to submit payment files to Bacs through Bacstel-IP software, which is a Bacs-approved software that allows you to create and submit payment files electronically. This option is suitable for businesses with a high volume of direct debit payments and the resources to handle the process in-house.

2) Direct debit bureau

A direct debit bureau is a third-party service provider that specialises in submitting payment files to Bacs on behalf of businesses. They handle the entire process on your behalf, including obtaining authorisations and mandates, creating payment files, and submitting them to Bacs. They have slightly higher fees, but can make your process very simple and time-effective.

Ultimately, the choice between doing it yourself or going through a direct debit bureau will depend on your company’s specific needs and the resources available to you. It is a good idea to consult with your bank or the direct debit bureau to decide what the best option for you will be.

Make sure you always read and understand the terms and fees of the payment processors or banks before you sign up for an account and start using their services. Again, it is a good idea to spend time researching this beforehand as it will save you money and hassles in the long term. Overall, receiving payments online through direct debit can provide a convenient and efficient payment option for e-commerce companies, but it is worth taking your time to understand the full process, terms and regulations before setting it up.

Factors to help you make the right choice for your e-commerce payments

In this blog post we’ve talked through the benefits of receiving online payments and how to set them up through various platforms. Below are a few factors to consider when deciding what the best payment option is for your e-commerce business:

Payment types accepted: Consider the types of payments that you will accept, such as credit and debit cards, direct debit, e-checks, etc. and ensure that the payment processors you choose support these options.

Currency support: If you're an international e-commerce business, ensure that the payment processors you choose support multiple currencies, so you can receive payments in the currency of your choice. This will benefit you and your customers!

Fees and rates: Compare the fees and exchange rates of different payment processors to ensure that you're getting the best deal available to you.

Security: Make sure that the payment processors you choose are PCI-compliant, ensuring that credit card information is securely transmitted and stored.

Integration: Consider how easy it will be to integrate the payment processors into your e-commerce platform, and if the payment processors offer plugins or APIs that can be used to integrate. If necessary, you can work with a web developer or other service provider to help get you set up.

Customer support: Consider the level of customer support that the payment processors offer, in case you run into any issues. Ideally they should have excellent customer service ratings so you’re never

User experience: Consider the user experience of your customers while making payments, it should be easy and secure. Returning customers are a great asset to your business.

Thinking through these factors will help you make an informed decision on which payment option is best for your e-commerce business.

Using a money transfer service with wamo business

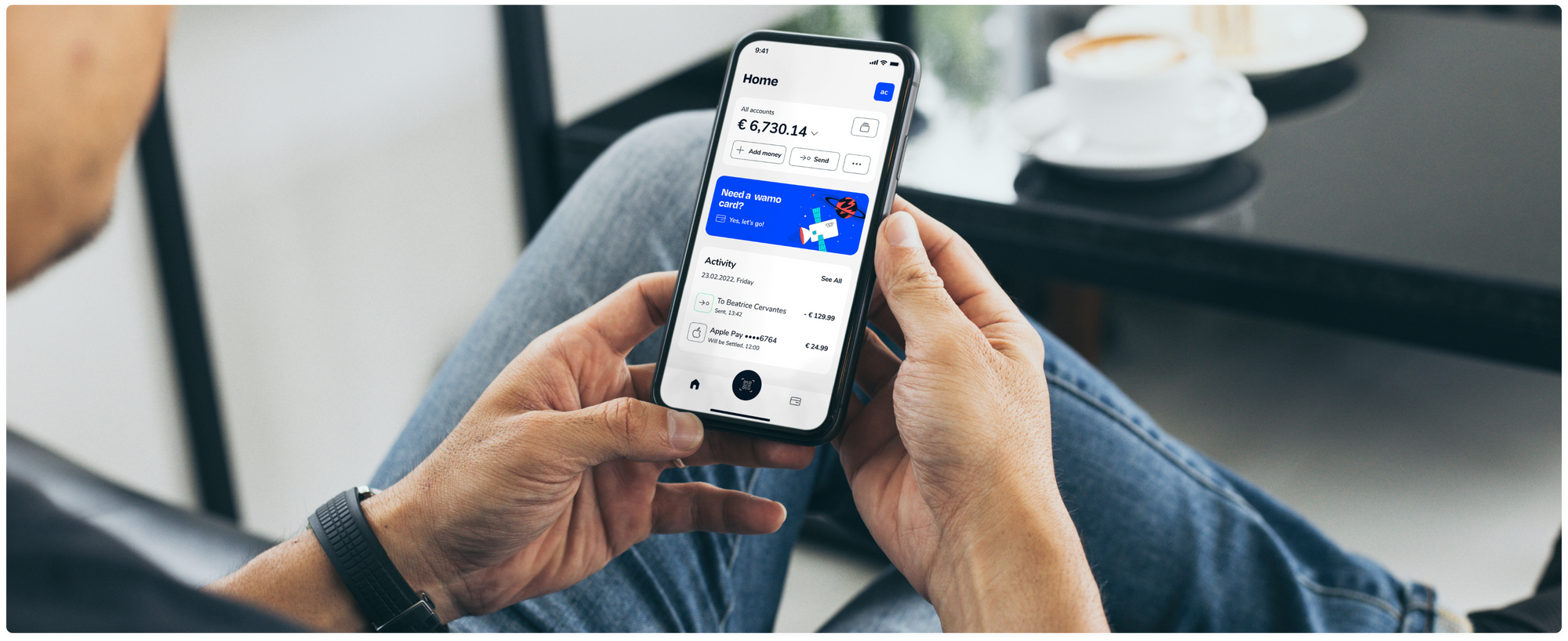

Once you open a multi-currency account with a financial management and payments platform like wamo, you can receive payments in various currencies and hold them in the account. This eliminates the need for currency conversion and the associated fees.

Additionally, you can withdraw the money that your customers have paid you. This can be done through your merchant accounts like Paypal or Mollie. This means you can access the funds in the currency of your choice, as well as use them to pay for goods and services you need, or to transfer money to other accounts.

wamo also provides a dedicated money transfer feature that allows businesses to easily send and receive money internationally. This can be done through the wamo app or web app, and the process is typically faster and cheaper than traditional money transfer methods.

wamo offers full transparency on exchange rates and fees. There are no surprises – you’ll always see how much you’ll receive or pay before initiating a transfer.

This dedicated money transfer service that wamo offers will save your business time and money, and also avoid the hassle of dealing with multiple payment providers.

at wamo you can get 3 months of Shopify for $1 / month if you simply become a wamo business account holder. Basically, with wamo, you can have your e-commerce business setup and ready to run right away!

How to open a business account with wamo

Opening a business account with wamo just takes 10 minutes and isa straightforward process. As a fintech company, wamo is a fast and easy solution for starting your e-commerce business in no time.

Here's a general guide on how to open a business account with wamo:

You will need to provide some basic information about your business, such as your business name, address, and contact information when you open a business account with wamo. You will also need to provide information about the business owner(s) or authorised representative(s), such as their name, address, and government-issued ID.

After these steps have been completed we’ll ask you to verify your ID so we can make sure you are who you say you are.

Once verified, you can start receiving payments in multiple currencies through wamo's borderless account and payment API. This can help mitigate cross-border transaction fees and currency conversion fees, making the checkout process more seamless for your customers.

As a financial management service provider and a payments platform in one, wamo is much more than app and operates differently to the traditional institutions you know. The features and services are designed specifically for small businesses and entrepreneurs to meet their specific needs. We at wamo provide human-centred support at every step of the way! The best part about wamo is that it is really big on great, personal customer service. To speak to a wamo team member email us on support@wamo.io or use the chatbox on the website.