In recent years, there has been a major shift from traditional financial services to digital options. This is because digital options offers many advantages over traditional financial services, such as 24/7 access to your account, lower fees, and the ability to send money internationally. If you're looking for the best financial service options in Estonia for your business, the good news is that there are many great choices available for you. These options not only enable you to run a business internationally but also help you to manage your finances smoothly and effectively.

What are digital financial services and what are your options?

Some people may confuse ‘digital financial services’ and ‘online financial services’, thinking that they are the same thing. However, there is a difference between what these two terms refer to. Online financial services refer to the accessibility of your account through a simple device where you get all your financial details in one place. On the other hand, digital financial services means you are using all the aspects of related services to manage your everyday business finances.

There are now more financial service options available than ever before. If you feel like your branch is too far away or too constrained by the limitations of traditional infrastructure, consider some of the digital options that are available to you.

Advantages of digital financial services in Estonia

1. 24/7 access to your account: With digital financial services, you can check your account balance, transfer money, and make payments anytime, anywhere. This is a major advantage over traditional counterparts, which typically have limited hours and are closed on weekends.

2. Lower fees: Digital platforms tend to have lower fees than traditional institutions because they don't have the same overhead costs. For example, you may be able to get away with paying no monthly maintenance fee with a digital financial services provider.

3. The ability to send money internationally: If you need to send money to family or friends overseas, digital platforms make this process much easier and cheaper than traditional institutions. For example, TransferWise allows you to send money at the real exchange rate with no hidden fees.

4. Better interest rates: Because digital platforms don't have the same overhead costs as traditional institutions, they can offer better interest rates on savings accounts and loans.

5. Greater transparency: Digital platforms are typically more transparent than traditional institutions when it comes to fees and charges. It is more or less standard practice now for digital apps and payment platforms to provide a thorough pricing page that outlines all potential fees and charges so that there are no surprises down the line. If you don’t see this page, move on!

Which platforms offer digital financial services in Estonia?

There are many digital platforms to choose from in Estonia that offer digital financial services. This includes a set of traditional institutions in Estonia as well as new financial service providers and payments platforms in the market.

Traditional Banks in Estonia

LHV Bank

Established in 1999, LHV Group offers brokerage services and portfolio management services. As part of the group's 2009 expansion, LHV Pank was established to provide retail and corporate banking products and services to individuals and businesses. It is the 4th largest bank in Estonia in terms of total assets and offers services like retail banking, business banking, private banking and leasing.

SEB Bank

SEB Pank is a part of SEB Group (Sweden). As a universal bank, SEB Bank provides retail, private, and corporate banking products and services. In addition to financial advisory services, SEB Pank offers short-term or long-term financing solutions, as well as current assets and liquidity management services. SEB Pank also provides pension plans and insurance.

Swedbank

In addition to accounts, mortgages, insurances, credit cards, loans, pensions and investments, Swedbank offers a wide range of financial services. It promotes financial literacy, entrepreneurship, and social participation through the development of the whole society.

Financial Service Providers: Alternate Options for Digital Finances in Estonia

Financial service providers are newer fintech companies in the industry that offer Estonian businesses a variety of financial services. Unlike traditional institutions, these providers are more flexible and quick in providing business accounts, debit cards, low fees and fast payments. Additionally, these fintech solutions are more convenient, technologically advanced and can be managed entirely online.

Wise

Formerly known as TransferWise, Wise has been a leader in providing cheaper financial solutions than traditional banks. The platform allows you to run an international business in Estonia and move your money between 50+ currencies at the real exchange rate. You can also get a Wise’s multi-currency account, which is free to open and lets you hold and manage money in multiple currencies.

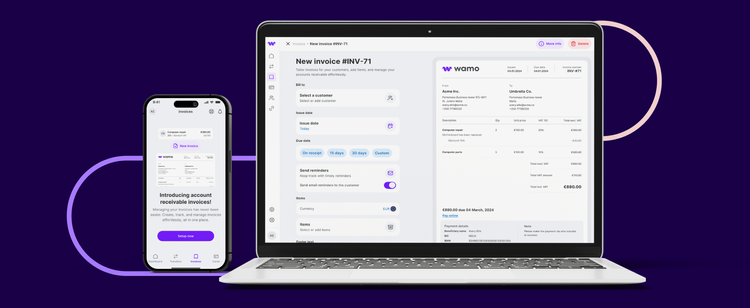

wamo

wamo is a rising player in the fintech industry that has recently been gaining popularity for their flexible financial services and ease in opening business accounts in Estonia. With an extensive set of features and low monthly fees, wamo enables business owners to do cross-border business easily and affordably. wamo offers team finance management , physical and virtual debit cards, SEPA and international transactions and multi-currency accounts among other things.

Better than traditional business account in Estonia: wamo

While there are multiple benefits offered by digital and traditional institutions, they simultaneously come with either hidden costs or stringent requirements that can sometimes make it difficult for new business owners to open a business account in Estonia.

However, it is also important to note that, if you are unable to open a business account with any of the financial service providers, you will not be eligible to run a business in Estonia. That’s where wamo has been making the process super easy.

Born out of the common challenges that businesses face when trying to open a business account in Estonia, wamo has made the process as smooth as possible. wamo offers zero setup fees, low conversion rates, free SEPA transfers, free debit cards and competitive subscription plans. It’s possible to open a business account in just 10 minutes.