Most entrepreneurs with an eye on expansion will consider the UK as the top destination to start a limited company. Thanks to the UK's well-established legal system, business opportunities and diverse customer base, entrepreneurs have the assurance that their company will be in good hands in the country. What's more, the country's efficient financial sector provides access to a wide range of banking and investment products.

But the best thing about opening a company in the UK is that you can do this entirely online. You don't have to pack your bags, apply for a visa or visit the country to open your business. All you need is a business idea and the motivation to run an international business without worrying about boundaries.

So, before starting your own limited company in the UK, it is important to familiarise yourself with all relevant requirements and regulations. This guide will help with starting a limited company online in the UK including researching banks and financial services, necessary documentation, the process of applying for companies limited company registration and some of the advantages of having a limited company in the UK.

What is a company formation in the UK?

Creating a company is the process of registering your business as a limited company with Companies House - the UK Government's official company registrar. It is the only organisation in the UK that can officially incorporate a and register a limited company.

After your company has been formed, it creates a legal entity of your business through which individuals, partners or corporate bodies can operate their businesses.

Almost all private companies are limited by shares, which are set up to generate profits for their shareholders. If you operate as an unregistered entity or sole trader, there will be no legal separation between you and your business or personal assets. In such a situation, your personal finances or assets could be at risk if something goes wrong.

What is the advantage of a limited company UK?

1) Limited liability: In a limited company, the owners are not personally liable for any debts or obligations of the company. This protection comes in handy if you want to start your own business without worrying about personal financial losses.

2) Tax advantages: Limited companies enjoy several tax privileges that make them an very tax efficient and attractive option for businesses of all sizes. For example, you are eligible for lower corporation tax and you can also claim relief on business expenses. Likewise, if you give yourself a salary from the company's profits, you will only be paying income tax and National Insurance on that salary.

3) Easier registration and business formation: Limited companies are allocated a unique corporate number and are subject to less formal legal requirements than ordinary businesses. This makes it easier for you to set up your business, find customers, register trademarks and carry out other essential activities.

What are the 2 key types of limited companies in the UK?

The two key types of limited companies in the UK are:

- Private Limited Company (Ltd): This is the most common type of limited company in the UK, and is typically used by small to medium-sized businesses. A private limited company is owned by its shareholders, who are not liable for the company's debts beyond the amount they have invested in the company. The company's shares cannot be traded publicly, and there are restrictions on the transfer of shares.

- Public Limited Company (PLC): A public limited company is a company whose shares are traded on a stock exchange, and is required to have a minimum share capital of £50,000. A PLC is owned by its shareholders, who are not liable for the company's debts beyond the amount they have invested in the company. The company's shares can be traded publicly, and there are no restrictions on the transfer of shares. PLCs are subject to more stringent regulations and reporting requirements than private limited companies.

Is it better to be a sole trader or limited company?

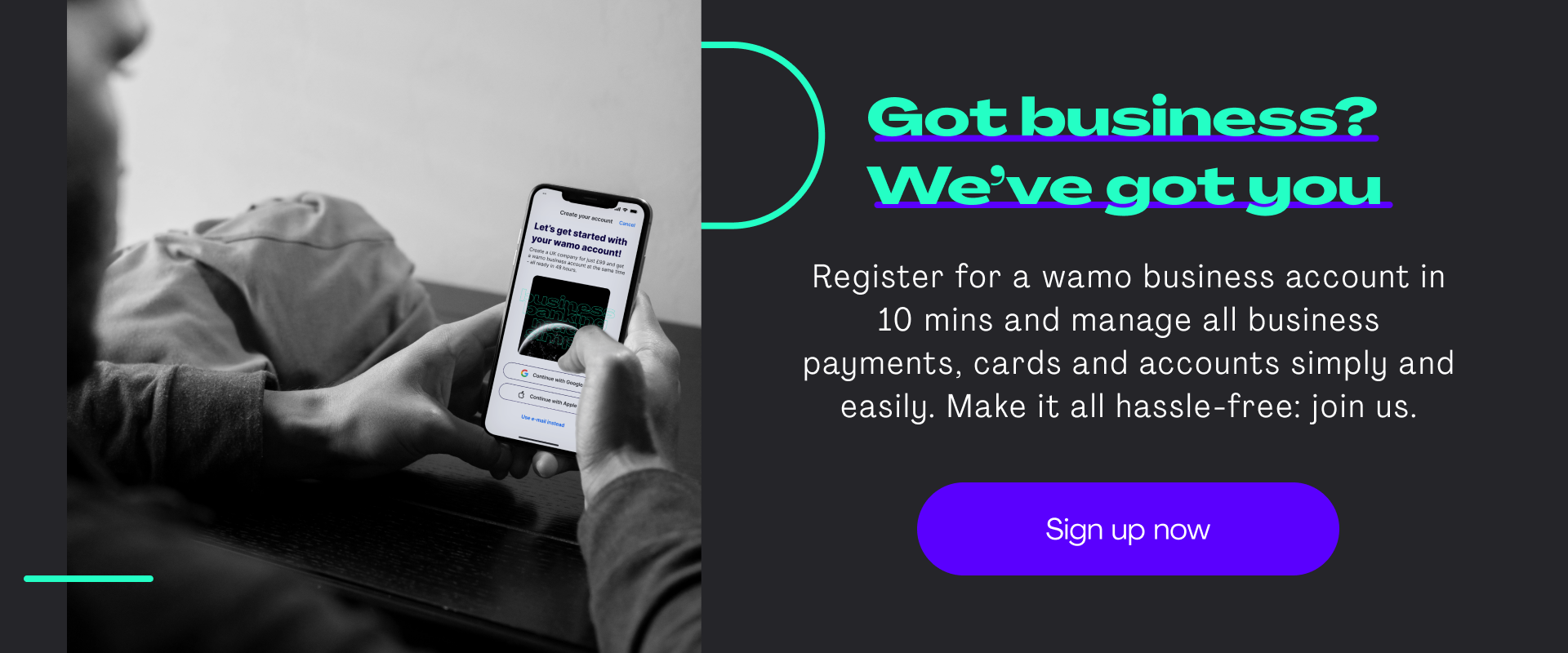

Here is a table that outlines some of the key differences between sole traders and limited companies:

Based on the table, it is evident that a limited company offers several advantages over a sole trader, including limited liability, lower tax rates, more credibility, and easier access to finance. However, a limited company also involves greater administrative requirements, such as filing annual accounts and returns with Companies House, and keeping detailed records of company affairs.

How to open a private limited company in the UK?

The process of opening a private limited company in the UK is relatively straightforward. Typically, you will need to provide information about your business and its shareholders (if any), submit an application form to Companies House, and pay fees. But before this, there are a few more steps that you need to complete.

1) Company name: The name of your company is essential, and you will need to choose a legally valid name. You can use any name that you wish, but it must be registered with Companies House (and may need to be protected by copyright or trademark rights).

2) Registered office: Your company will also need a registered office - this is the address at which your business will conduct its day-to-day operations (this can be a virtual address too). The registered office address can be anywhere in the UK, but it's advisable to choose an easily accessible location.

3) Directors: You will need to appoint at least one director - generally, this is a person who has experience in running a business and knows enough about company law to act as your representative. Other directors may be appointed from the shareholders or members of staff, depending on your company's legal requirements. You will also need to ensure that all appointed directors are properly registered with Companies House (and liable for any financial penalties if they neglect their duties).

4) Shareholders: You will need to establish your company's shareholders. This is a group of people (usually individuals, but sometimes businesses) who own shares in your company. The number and type of shares that they are entitled to will depend on the legal requirements of your business - for example, if you are carrying out a public offering (a process where new shareholders purchase shares from existing ones), you may need to register with the Securities and Investment Board (SIB).

5) Financial documentation:

- Your company will also require various documents like:

- Copy of your passport or identity card

- A completed application form (available from Companies House)

- Memorandum and Articles of Association

- A certificate of incorporation

- Tax number

- Proof of shareholder structure

- Proof of company address

What is a Directors' Service Agreement?

A Directors' Service Agreement (DSA) is a document that sets out the details of how a limited company will be run and managed. It also outlines what you are responsible for as a director, which parts of your job you'll take charge of and which parts you won't do yourself. The DSA must be signed by all directors to say that they agree with what it says. This way, you're all working on the same page when it comes to running your business and reaching goals together.

What does ‘Self-employed’ mean?

What’s the difference between being self-employed and being a limited company, in terms of tax, legal liability and social security arrangements? When you become self-employed, you can choose what hours you work and what services to offer. You have complete control over your business as well as its success or failure. You are responsible for paying your own taxes and National Insurance contributions (NICs). For example: If you work for yourself as a consultant or freelancer, this would be considered self-employment rather than limited company employment. If you run your own business using cash flow from clients or customers instead of loans from banks, it is also likely that this will be classed as self-employment rather than limited company employment.

What is a sole-trader?

A sole trader, also known as a sole proprietorship, is a type of business structure where an individual runs and owns a business. As a sole trader, the business and the owner are considered as one and the same entity for legal and tax purposes. This means that the owner has complete control over the business, including its finances, operations, and decision-making and can be held personally accountable for their business.

Sole traders are responsible for following up on all tax and debt payments associated with the business. They are also personally liable for any legal issues or debts incurred by the business, so if you are wishing to become a sole trader, it is crucial to be aware of the duties that fall on to you. However, the main advantage of being a sole trader is that they have complete control over the business and can keep all the profits generated by it.

Although a common practice especially among those with a smaller size of businesses, the pros and cons of being a sole trader vary, so it is not preferred by every small business., Some common examples of sole trader businesses include freelancers, consultants, and small retail or service businesses.

Getting a business account in the UK

After completing your new company and registration process, it is time to get a business account for your finances. Here, you will be able to track your company's finances and make sure all tax obligations are met.

While this step is not a mandatory requirement for running a company in the UK, we highly recommend you get a business account as you will be running an international business and would be receiving and making payments in multiple currencies.

Having a business account in the UK can save you from heavy conversion fees, costs involving international transfers and additional postage fees from overseas. In addition to this, you can also manage your company's entire financial management in a single place.

How to get a business account in the UK?

Multiple banks in financial institutions in the UK offer business accounts. Some of the famous banks in the UK are HSBC, Lloyds Banking Group, and RBS. However, if you are a small business or a new business owner, it can be difficult to open an account with these popular nationalised banks.

As an alternative, financial service providers like wamo, Wise, and N26 can enable you to open a business account with them. For example, wamo's Grow and Scale plans are generally more cost-effective, technologically smart, flexible and offer a less fee on conversion rates, withdrawals, moving multiple currencies and international transfers. At the same time, the company as a holistic financial management platform has enabled entrepreneurs from 31 countries to set up a business in the UK and takes their customer service very seriously. So, you can be assured that your financial aspects are in good hands.

Probably the best thing about wamo's account is that it lets you get started in no time - After the waitlist phase, you can register for an account in 10 minutes and your application will be processed within 24 hours.

To get set up with wamo, download the wamo business app from Google Play or the App Store, submit your required documents, open a business account and get started with your virtual debit card right away!