When you are a small business owner, one of your biggest priorities is your time. Because saving your precious hours means increased revenue and more focus on business growth.

And one aspect that comes in handy to save you some sweet time is the digitalisation of your finances. The need for digital banking in small businesses has never been more important.

Business owners often have regular meetings with their associates, sales targets and strategies to chalk out. And dealing with endless paperwork, standing in long queues at the bank and getting involved in time-consuming manual processes is the last thing you would want to include in your checklist.

The good news is that digital banking has made things easier for small business owners. It offers a range of digital solutions that are just tailored to meet specific requirements.

In recent research, 12.6 million Brits will exclusively have digital bank accounts. And by 2023, 5.3 million more Brits (10%) plan to open digital-only bank accounts. It is anticipated that 22.6 million (43% of all bank account holders) would have digital-only accounts by 2028.

So, why is everyone embracing the trends of digital banking? Let's explore this and see whether it's useful for you and how you can find best online banking solutions for small businesses.

What is digital banking for small businesses?

Simply put, digital banking for small businesses means entrepreneurs can deal with their day-to-day financial operations without having to visit the bank. It's like having a virtual bank at your fingertips, which can be accessed any time of the day through a computer, smartphone or tablet.

So imagine that you have to make an urgent international transfer to one of your suppliers. Given that banks have hundreds of customers each day, it's not always productive to wait for long hours in the queue to just make a single transaction - especially when the demand is urgent. In such cases, business owners can access their accounts virtually at any given time or place.

Embracing digital banking means bidding farewell to those dreaded trips to the banks or piles of paperwork. Here, entrepreneurs can enjoy a wide range of online banking solutions and can also ask banks to customise them for their business needs. From online account management and electronic fund transfers to mobile banking apps and digital payment platforms, these tools empower you to take control of your finances effortlessly.

The relevance of digital banking becomes clear when you look at statistics like these:

The March 2023 Open Banking Impact research estimates that about 750,000 small to medium-sized companies (SMBs) are already utilising open banking products, which represents a penetration rate of 16%, higher than the 11% reported for consumers – a discrepancy that the research states is only expected to grow.

What’s the need for digital banking for small businesses?

Now, let's take a closer look at specific benefits that can be enjoyed by adopting digital banking:

Time is money and digital banking saves both!

Let's admit it, the ability to make transactions and do banking from anywhere has a great amount of comfort and convenience.

Many digital banks offer their own banking apps. So now we can transfer funds, withdraw money, check overdraft notifications, manage team budgets and so much more, in just a few swipes. They really do save time - and by now we’re all used to doing everything on our phones

Greater control of finances

Well-managed finances mean you have better control over your profits, salaries and costs. Digital banking brings an opportunity to have a closer look at your finances and have real-time access to your money. When you are banking in person, you often bear unknown costs on your account, pay heavy transfer fees and have to stick to banking hours or rush to make it to the bank before closing time.

These things don't count when you have access to digital banking - you can view your account balances, monitor transactions and make transfers anytime, anywhere, be it at the crack of dawn or in the middle of the night - it's all under your control. Some platforms even offer intuitive tools to categorise expenses and create custom financial reports, making it a breeze to stay organised and make informed decisions.

Secure and reliable

We all know that your hard-earned money deserves top security. Digital banking may have a whimsical touch, but when it comes to security, it's all business! Today, digital banks spend heavily on extra security measures, encryption technology and multifactor authentication to protect your financial data. For example, you have options to set up pins or biometric login on your mobile app or online bank account.

You may also have noticed that digital payments and e-wallets have actually started offering more security than what you get with physical debit or credit cards. So, adopting digital banking means that your information is in safe hands, protected from unauthorised access.

More features

With digitalisation comes fresh ideas! Many fintech companies and digital banks also offer personalised financial advice, saving tools, calculators or virtual assistants to simplify your financial operations. Some financial apps like wamo also dedicate a live account representative to your business account - which lets you chat with the representative, seek advice and hear about all solutions for your financial transactions.

Digital banking also lets you make quick and secure electronic transfers, pay bills online, and even offer digital payment options to your customers. It's the modern way to transact, offering convenience for both you and your clients.

Access to Financial Insights

Many digital banking platforms provide valuable insights into your business's financial health. You can analyse cash flow patterns, track expenses, and gain a deeper understanding of your financial performance through easy-to-read reports and charts. Armed with these insights, you can make smarter decisions to drive your business forward.

How digital banking can improve cash flow management for small businesses

Small business owners are often expected to be quick - be it pivoting, keeping up with the competition, finding market gaps or adapting to new technologies. And amidst all of these quick decisions, it's also important to be smart with your cash flows.

Thankfully, digital banking brings a whole lot of benefits that can seriously help in levelling up the cash flow game, with:

- Real-time visibility into your account balances

- Automated transaction tracking

- The convenience of cash flow forecasting tools

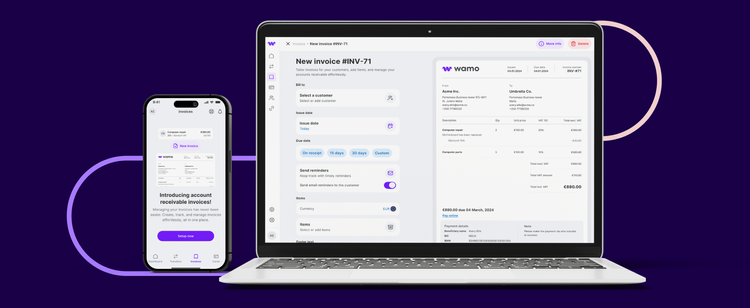

- Seamless invoicing and payment processing

- Timely payment reminders

You'll be able to ensure that money flows in on time, keeping your cash flow sailing smoothly. Additionally, some digital banking platforms provide access to working capital solutions, giving you the flexibility to bridge temporary gaps.

Features to look for in digital banking solutions for small businesses

As you embark on this thrilling adventure of finding your digital banking solution for small businesses, it's also important to be clear about what exactly your business needs. Ask yourself these questions before closing the deal with your financial provider.

Is your digital-banking user friendly?

An easy-to-use app is a gateway to quicker transactions and less turnaround time. Look for platforms that have an intuitive, easy interface, so that your team can also quickly adapt to it and utilise the system without a need to learn and adapt.

Can you manage multiple accounts?

Small businesses often deal with multiple accounts, such as checking, savings and credit cards. So, when it's time to choose a service provider, look for something that lets you manage a lot of accounts from a single platform. This way, you save more time and get a comprehensive outline of your financial scene.

What kind of accessibility do you have?

In a smartphone-driven world, it's also important to have your digital banking in your pocket. So, look for a platform that brings a solid and versatile app, that lets you manage your finances from any corner of the world. With mobile accessibility, you can stay connected to your business finances wherever you are!

What kind of integrated solutions are there?

Seek a digital banking solution that integrates with popular payment gateways and offers features like electronic invoicing, digital payment acceptance, and automated payment reconciliation. This integration simplifies your cash flow management and improves customer convenience.

What are the security measures?

Protecting your business's financial data is paramount. Ensure that your chosen digital banking solution employs robust security measures, such as encryption and multi-factor authentication, to safeguard your information. Look for features like real-time transaction monitoring and alerts that help detect and prevent fraudulent activities.

Is there a high-touch service?

As a small business owner, you often deal with frequent cash flows and may need to reach out to your financial providers more than usual.

And, not just a bot or AI, but a living and breathing human with a name and problem-solving skills. So, evaluate the type of customer support that your prospective financial provider offers.

How many debit cards can be issued?

Never underestimate the power of a robust and versatile card! It can ease up your international and local transfers while letting you manage multiple currencies smoothly.

While some financial providers just offer a single virtual card, others like wamo can offer up to 10 free virtual debit cards that can be used by your team as well. Analyse your requirements and choose the service that suits your business best!

What are the features for reporting and analytics?

Insights into your financial performance are vital for informed decision-making. Look for a digital banking solution that provides comprehensive reporting and analytics tools. These features allow you to generate customised financial reports, track key performance indicators, and gain valuable insights into your business's financial health.

What are the Digital Banking Fees to Expect?

When it comes to online banking fees, the good news is that online banks usually have lower fees compared to traditional banks. Since online banks have fewer overhead costs, they pass on the savings to their customers. However, it's still important to be aware of some common fees you might come across. Let's break it down:

- Monthly Fees: A few online banks have a monthly account maintenance fee, especially when you don't meet the specific balance or activity requirements.

- Overdraft fees: If you spend more money than your limit, an overdraft fee may apply.

- ATM fees: In case you make a withdrawal from an out-of-network ATM, you may have to pay withdrawal fees for the same. So, go ahead and check if your online bank reimburses ATM fees or has a network of fee-free ATMs to avoid extra charges.

- Wire transfers fee: Sending or receiving a local or international wire transfer comes with some kind of fee. This differs based on the bank you choose.

- Stop payment fees: If you need to stop payment before it's processed, some online banks may charge a stop payment fee.

- Foreign transaction fees: If you're purchasing a foreign currency, be aware that some online banks may charge a fee for foreign transactions.

How to choose the right digital banking for your small business

- Evaluate Your Business Needs: Start by assessing your specific business needs. Consider factors such as the volume of transactions, the complexity of your financial operations, and the scalability of the digital banking solution. Understanding your requirements will help you narrow down your options and find a partner that aligns with your business goals.

- Research Reputation and Reliability: Do your due diligence and research the reputation and reliability of potential digital banking partners. Look for well-established financial institutions or reputable fintech companies that have a proven track record in serving small businesses. Read customer reviews, check their regulatory compliance, and ensure they have robust security measures in place to protect your financial data.

- Seamless Integration: Consider the compatibility of the digital banking partner with your existing systems. Look for a solution that seamlessly integrates with your accounting software, payment gateways, and other essential business tools. This integration streamlines your financial operations, reduces manual work, and ensures a smooth flow of data across platforms.

- Range of Services: Assess the range of services offered by the digital banking partner. Besides basic banking functionalities, such as account management and payment processing, consider additional features that can benefit your business. These may include cash flow forecasting, invoicing solutions, access to working capital, and robust reporting and analytics tools. Choose a partner that provides services that align with your specific needs.

- Pricing and Fees: Carefully evaluate the pricing structure and fees associated with the digital banking services. Compare different providers to ensure you understand the costs involved, including transaction fees, monthly subscription fees, and any additional charges for specialised features. Choose a partner that offers transparent pricing and a fee structure that aligns with your budget and expected usage.

- Future Growth and Innovation: Consider the digital banking partner's commitment to innovation and their ability to adapt to evolving technologies. Look for a partner that invests in ongoing development, regularly updates its features, and stays ahead of industry trends. This ensures that your digital banking solution remains relevant and can grow alongside your business.

The Best Online Banks for Digital Banking for Small Business Owners in the UK

Here are some of the best online banks in the UK that cater specifically to small business owners like you. Check them out and find your perfect digital banking partner:

wamo: Of course we’d like to start with us! wamo is a financial management service provider and a payments platform in one, but what we aim to be to your business is much more than a bank. Our commitment is to be a partner to our business owners, to take you from start to scale with all the support and confidence that you and your business idea deserves. It’s possible to open a multi-currency, team-centric business account and have it all up and running in a short time. Our number one priority is to provide in-person customer support. With wamo you’ll always get to speak to a human, we are here to get to know your business and to adapt to your needs.

Tide: Tide is a popular choice among small business owners due to its user-friendly interface and seamless integration with accounting software. With Tide, you can open an account in minutes, manage your finances on the go, and benefit from handy features like free card transactions, Instant invoice payment and creation, business loans etc. Tide has both, free and paid subscriptions, which can be altered based on specific business requirements. While an upgraded version comes with lots of convenient features, the free version still offers a lot of useful features. You need to be a UK registered business to have a Tide account.

Starling Bank: In addition to their personal account, Starling Bank has real-time insights, expense tracking and flexible payment options that are specifically designed for small businesses. The bank also gives the option to integrate with accounting software like QuickBooks, Xero, and FreeAgent. Probably one of the best things about Starling's business account is that it gives free UK bank transfers and a roster of currencies to deal with.

Revolut Business: Revolut has 4 million+ customers across the globe and lets business account holders hold, receive and exchange over 29 currencies. The exchange rate is also quite impressive and lets you make bulk payments (up to 1000 payments) in a few clicks. It offers multi-currency accounts, international payments at competitive rates, and expense management tools. With Revolut Business, you can also issue employee cards and customise permissions by paying some extra fees for the same.

FAQs

How does digital banking differ from traditional banking?

In the realm of banking, digital banking stands apart from traditional banking with its modern and innovative approach. Unlike traditional banking, which relies heavily on physical branches and in-person transactions, digital banking harnesses the power of technology to provide a seamless and convenient banking experience. With digital banking, you can perform various banking activities anytime, anywhere, through online platforms and mobile apps. From opening accounts to making payments, transferring funds, and accessing detailed transaction histories, digital banking offers a range of services at your fingertips. It eliminates the need for long queues and paperwork, providing efficient and instant financial solutions. While traditional banking still has its place, digital banking offers greater accessibility, flexibility, and speed, catering to the needs of the modern business landscape.

What types of services can small businesses access through digital banking?

Digital banking opens up a world of services and convenience for small businesses. Through digital banking platforms, small business owners can access a range of services designed to streamline their financial operations. These services include online account management, where businesses can easily view balances, track transactions, and manage their cash flow in real-time. Digital banking also enables businesses to make electronic payments, whether it's paying suppliers, vendors, or employees, with the click of a button. Additionally, small businesses can benefit from features like mobile check deposit, automated invoicing, integrated expense tracking, and access to financing options. With digital banking, small businesses gain greater control over their finances, save time on administrative tasks, and have the tools to make informed financial decisions. It's a game-changer for small businesses, empowering them to focus on growth and success.

How can digital banking help small businesses manage their finances more efficiently?

Digital banking empowers small businesses to manage their finances more efficiently through a range of features and benefits. With real-time access to their accounts, streamlined payment processes, and automated transaction tracking, businesses can save time and reduce errors. Cash flow forecasting tools help with planning and decision-making, while integration with accounting software eliminates manual data entry. Enhanced security measures provide peace of mind, and mobile accessibility allows for on-the-go financial management. Overall, digital banking saves time and costs, improves accuracy, and provides small businesses with the tools they need to effectively manage their finances and drive success.