First up, Revolut started as a prepaid card and money app back in 2015 and is now one of the most used financial service provider apps in the UK and many European countries. Revolut offers both business and personal accounts at various price points. Revolut has aimed itself at travelling business people and digital nomads right from the start with a focus on ease of spending money wherever you go without the hassle and expense usually incurred with traditional institutions and foreign exchanges.

At this point Revolut has more than 40 million customers world-wide. Along with challengers like Monzo and TransferWise (now, Wise), Revolut helped to challenge and change the financial service experience initially for consumers and then for businesses too.

wamo is a modern financial management and payments platform tailored for businesses, focusing on simplifying the process of obtaining and maintaining business accounts. It addresses the needs of small businesses and entrepreneurs who have faced challenges with traditional banks and digital financial service providers, which often rely on outdated processes and procedures.

For new business owners with residency in the country they are attempting to open a business in, both Revolut and wamo are excellent solutions. For those looking to open a business account for those who for one reason or another have become frustrated by or been denied access to a business account - wamo is a great alternative.

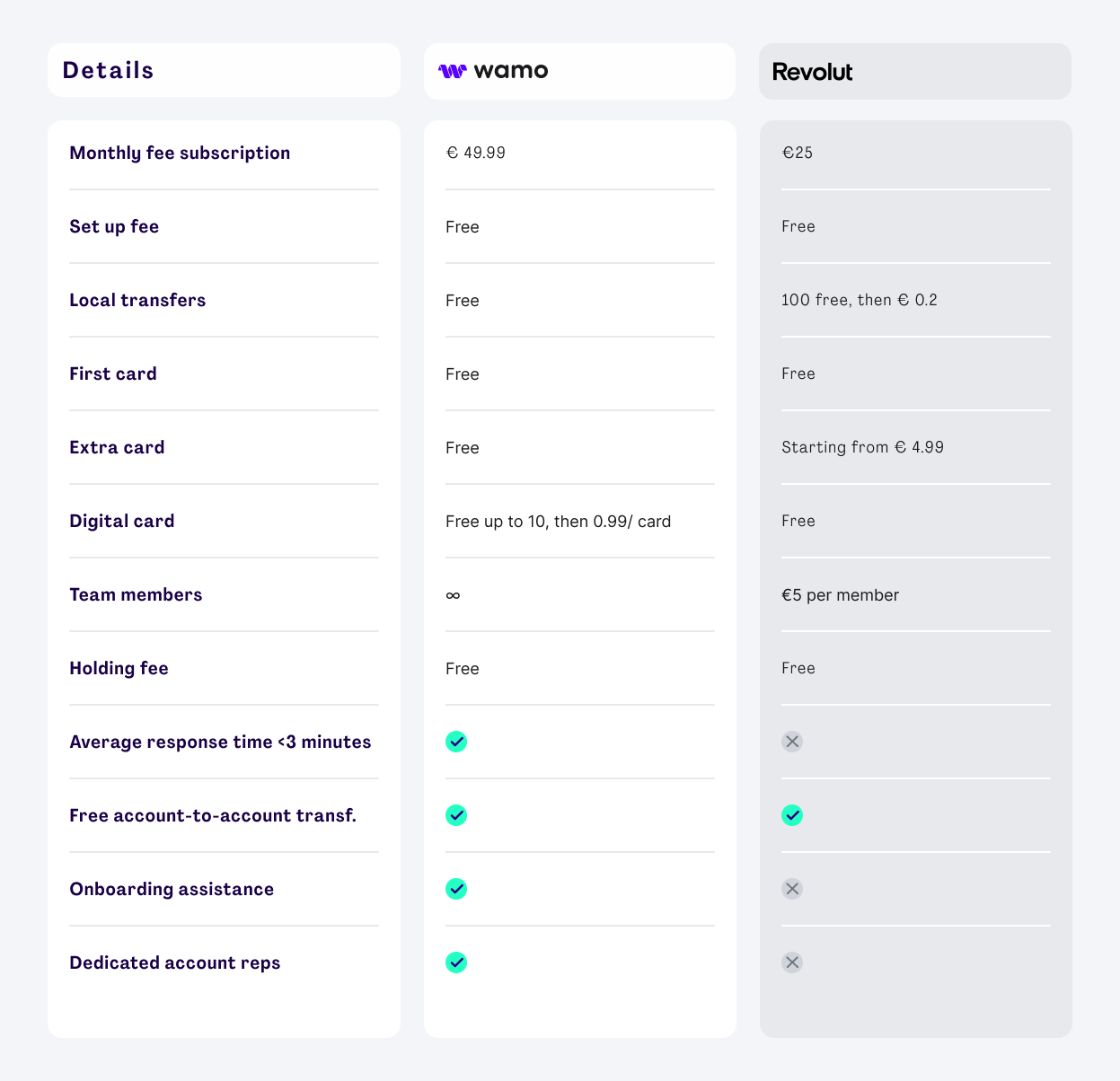

In order to compare wamo and Revolut we’ll look at both solutions’ most popular subscription packages: Revolut Grow and wamo Grow. Let’s see which business account will save you the most money and provide you with the best customer experience over all:

Revolut vs wamo : overview

Revolut’s Grow plan, starting at €25/month, offers competitive pricing compared to wamo’s equivalent plan. If your business primarily handles local transactions, be aware that exceeding certain thresholds (e.g., €1150) in local transfers will incur additional fees of €0.23 per transfer. For example, transferring €2300 in a month would add approximately €23 to your bill. Additional cards can be purchased for €4.99 each. This extra charge should be considered if you require multiple team cards. However, for micro and small businesses, especially those focused on international transactions (like e-commerce companies), Revolut remains an excellent choice due to its established reputation and digital convenience.

While wamo sets its Grow Plan subscription rate higher, it provides everything else for free, regardless of how your business performs over the month. If you switch to the annual plan, you can earn up to 1% cashback on all your spendings and receive a 20% discount on the subscription rate. Business owners who value personal customer service will appreciate wamo's quick response times and dedication to providing friendly, efficient service every time. Compared to Revolut, Wamo offers a more cost-effective solution with these added benefits.

When it comes to choosing the best business account for you, there are many things to consider of course, but we hope this guide has helped answer some questions especially if you are trying to choose between wamo and Revolut business accounts.