Digital-only financial service provider have been on the rise in recent years, as traditional institutions have been slow to adapt to the needs of modern consumers. This has led to a number of new players entering the market, offering innovative solutions that cater to the needs of digital-savvy consumers.

One of the most popular digital financial service providers in the UK is 3S Money. This young company has quickly established itself as a leading player in the space, thanks to its focus on providing a great user experience and its competitive fees.

Another growing digital financial service provider is wamo. This company has also been gaining traction in recent years, thanks to its focus on providing an affordable and convenient financial solution for entrepreneurs and corporations. wamo is particularly popular with small businesses and business owners who have struggled to open an account with a traditional bank.

So, which of these two digital financial service providers is better? Let's take a closer look at each one to find out.

Both the platforms can be used for international transactions, and come with their own cheap currency conversions, and some monthly fees. However, we'll compare them both in detail to see which one best suits your requirements.

At this point, 3S Money has been serving thousands of companies, directors and shareholders. While they grow at the fastest pace possible, they have processed €1 billion in client payments.

wamo on the other hand is a growing company with a versatile team which provides financial management and payments platforms for businesses of any size. Especially, when we talk about business owners, the company has plans for small businesses and corporates who have struggled in the past to open a business account.

Both digital financial service providers are blooming in the industry and are great solutions to start your international business from anywhere. With an open EU market, both financial service providers are offering great benefits.

Therefore, business owners who are struggling to meet the eligibility of local branches can go for wamo solutions, as it is more flexible and easier when it comes to business accounts.

But, of course, there are other factors too that you might want to evaluate before deciding your next move. Let's compare the costs, fees and benefits of both the platforms through their most popular subscription packages.

Subscription Plans

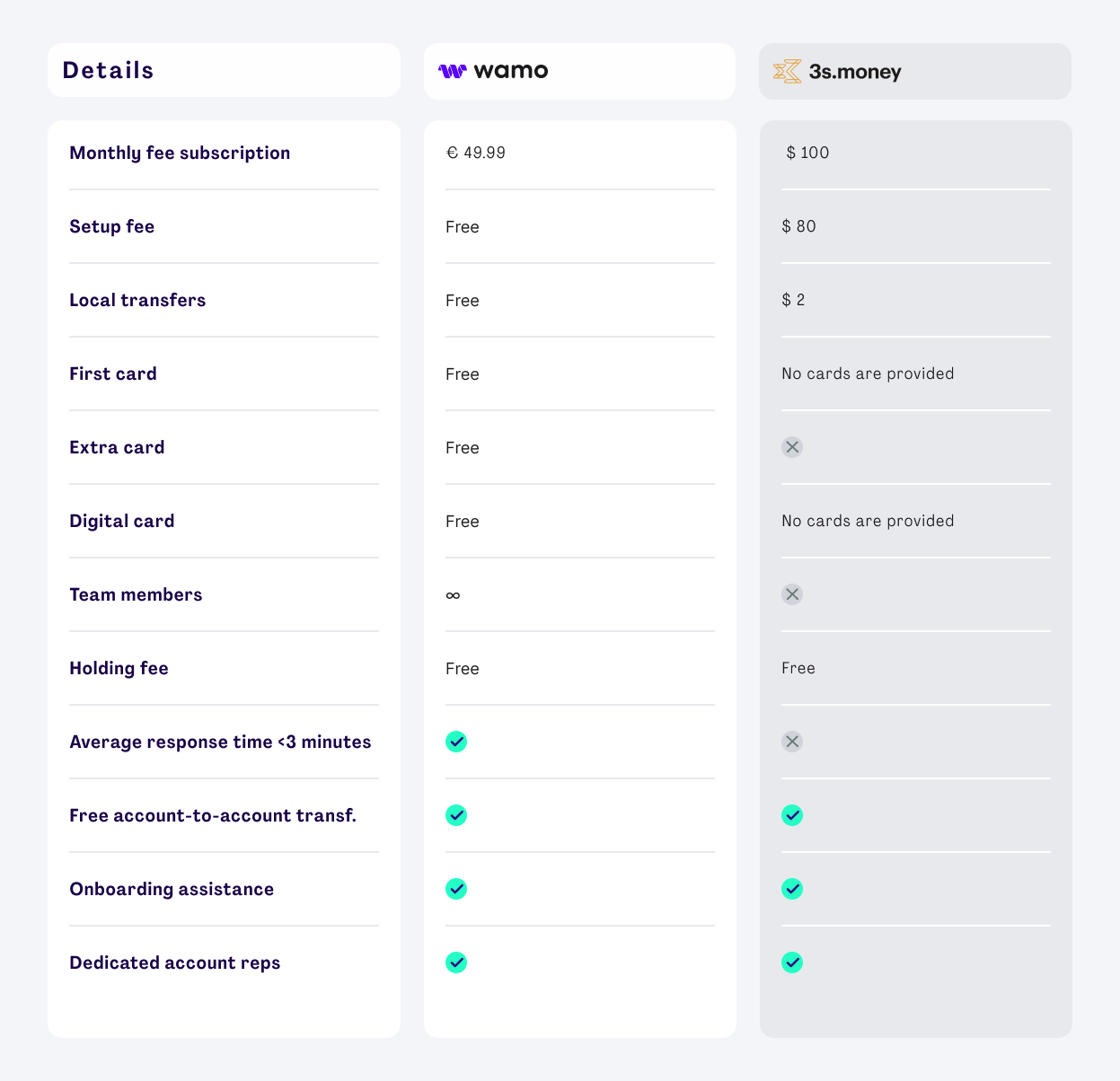

There's almost no difference between the monthly pricing of the two financial service providers. However, the 3S Money's subscription packages start from $25 (starter) and $100 (standard), while wamo is offering more benefits in its monthly plan. So if you are looking for more features at this price, then wamo is a better choice.

Additionally, 3S Money offers three types of packages that can go higher with some excellent benefits for big organizations. wamo Grow’s subscription rate also goes higher, which provides almost everything free, regardless of your business performance.

wamo's Grow Plan costs more but offers valuable benefits. With an annual plan, you get up to 1% cashback on all spending and a 20% discount on the subscription rate. Compared to 3S Money, wamo provides more comprehensive benefits, making it a better choice for businesses wanting all-inclusive service without hidden fees.

If you are a solopreneur or a freelancer, wamo further has set up free account openings for you to run your business, which makes it an ideal choice for people aiming to expand business but are solo in the game.

Money Transfers

3S Money offers fast and convenient money transfer services to its clients. The company facilitates transfers in more than 40+ currencies across the globe. On the other hand, wamo also offers quick and easy money transfer services to its users with real-time conversion rates, however with limited currencies. So, if your business has to deal with a lot of currencies, then 3S Money can be your choice.

Accounts and Cards

3S Money and wamo, both offer a very versatile multi-currency account. However, unlike 3S Money, wamo offers free virtual cards that are linked to your account and can be used for all your business transactions. You can use the cards to set spending limits, view transactions and track your balance in real-time.

Customer Support

Both have very reliable customer support teams that are always ready to help you with any query or issue that you may have. If you are looking for a quick turnaround time and a team that works closely with you, then wamo is a better option for you as it responds in less than 3 minutes.

So which one wins? wamo or 3s Money

It really depends on what your business needs are. Both these digital banks are great in their own ways and offer unique features to cater to businesses of all sizes.

If your business is currently growing, it is always good to choose a financial service provider that will grow with you.

Hope this guide helped you in solving your questions about business accounts and which provider you should go for.